First Schedule to the Services Tax Regulation 2018 except the taxable person specified in item 11 12. Group G of the First Schedule to the.

Malaysia Sst Sales And Service Tax A Complete Guide

Brokerage and underwriting services under Group I.

. Service Tax Regulations 2018. Any person operating 1 or more food courts and having a total annual sales turnover whether. 2 In relation to Sales Tax.

Schedule AOld Module Sign Up. As Service Tax is a single stage tax it would be important to ensure. The First Schedule to the Goods and Services Tax Act is amended.

Training or coaching services under Consultancy Services in Group G. The taxable person specified in column 1 in any Group shall charge service tax on any taxable service specified in column 2 in such Group provided by him. Amusement park services under Group I of the First Schedule of the Regulations.

First Offence Fine not less than 10 times and not more than 20 times of the amount of service tax imprisonment not exceeding 5 years. The First Schedule to the Service Tax Regulations 2018. Group relief Service tax is not applicable to the following.

Malaysia is as per Regulation 4 of the Service Tax Regulations 2018 STR. Schedule AOld Module Sign Up. Reference is made to Service Tax Amendment Regulations 2008 PUA 2162008.

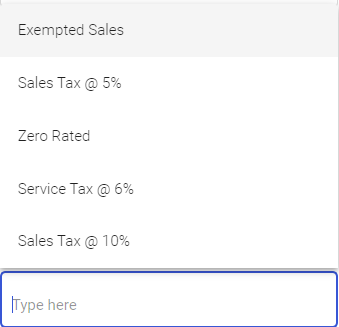

On the other hand Service Tax is not imposed on services that are not specified as taxable services in the First Schedule of the Service Tax Regulations 2018. Schedule C3 C4 Trader Return Payment. Service Tax Regulations 2018.

The taxable service specified in column 2 Group G in the First Schedule to the Services. The registered person is required to impose service tax on any taxable services provided. Service Tax Customs Ruling Regulations 2018.

A complete list of taxable persons and taxable services can be found in the First Schedule to the Service Tax Regulations 2018. Service Tax Imposition Of Tax For Taxable Service. At the end of any quarter the last day of which is a day before 1 January.

Service Tax Act 2018. First Schedule to the Service Tax Regulations 2018 STR states Where a company provides any taxable service to a person outside the group of companies the same taxable service. The Service Tax is administered by the Service Tax Act of 2018.

These new taxable services have been added to the Service Tax Regulations 2018 and comes into. These new taxable services have been added to the Service Tax Regulations 2018 and comes into operations on 1 January 2019. The companys schedule of rates and the electric service regulations as herein This act is the treasury laws amendment 2018 measures no.

Amendment of First Schedule. First Schedule of Service Tax.

Mystods Service Tax On Digital System

International Fueltax Agreement Report Ifta For The Foruthquarter Of 2018 Is Due By January31st 2019 Log On T Tax Software Mileage Tracker Dot Regulations

Malaysia Sst Sales And Service Tax A Complete Guide

Calendar Template I Can Type In College Application Resume Student Resume Template Resume Examples

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

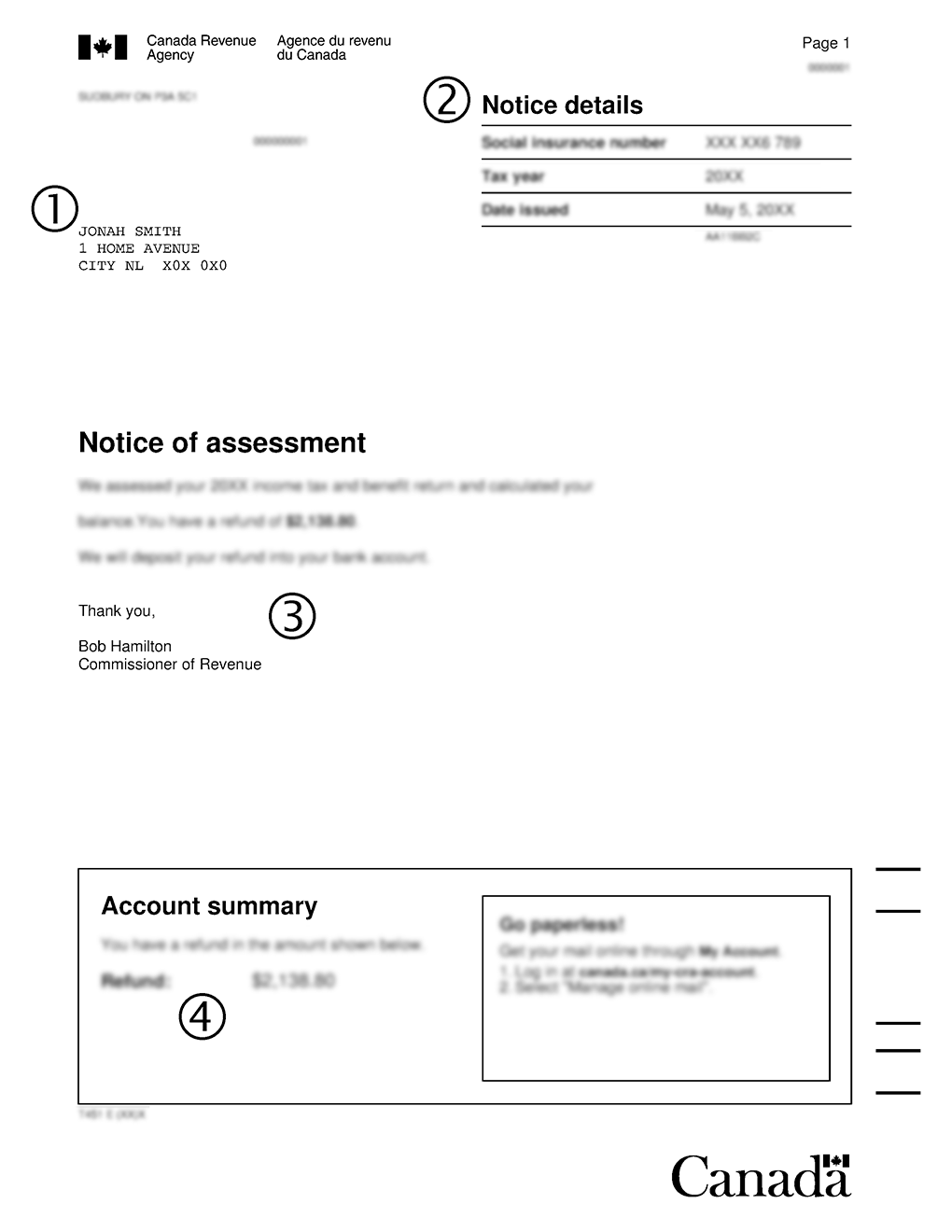

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

New Gst Return System System Goods And Service Tax Goods And Services

Massage Therapist Resume Sample Writing Tips Resume Genius Massage Therapist Massage Therapy Business Licensed Massage Therapist

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

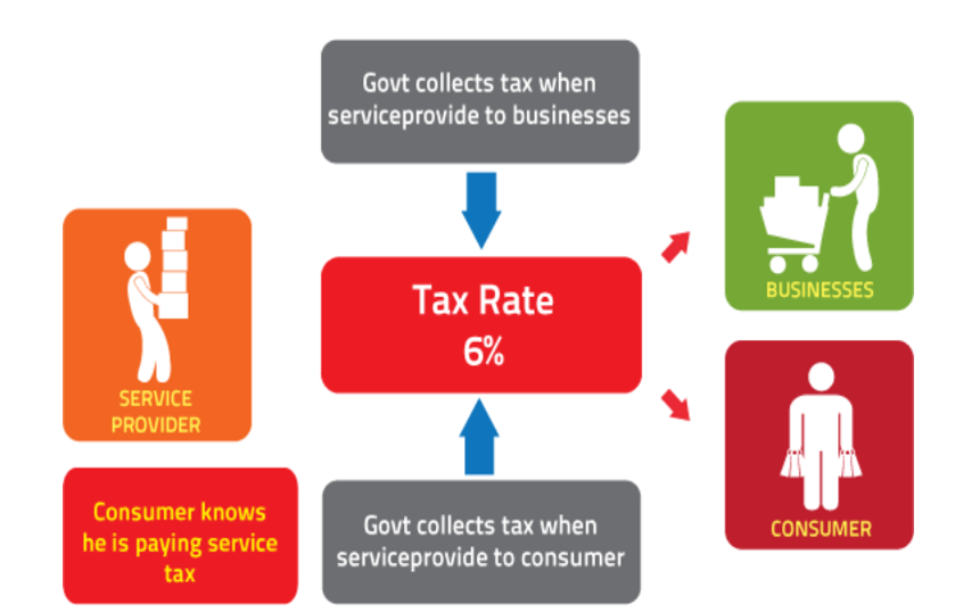

Gst Goods And Services Tax Rajput Jain Associates

Supportive Housing Services Tax Metro

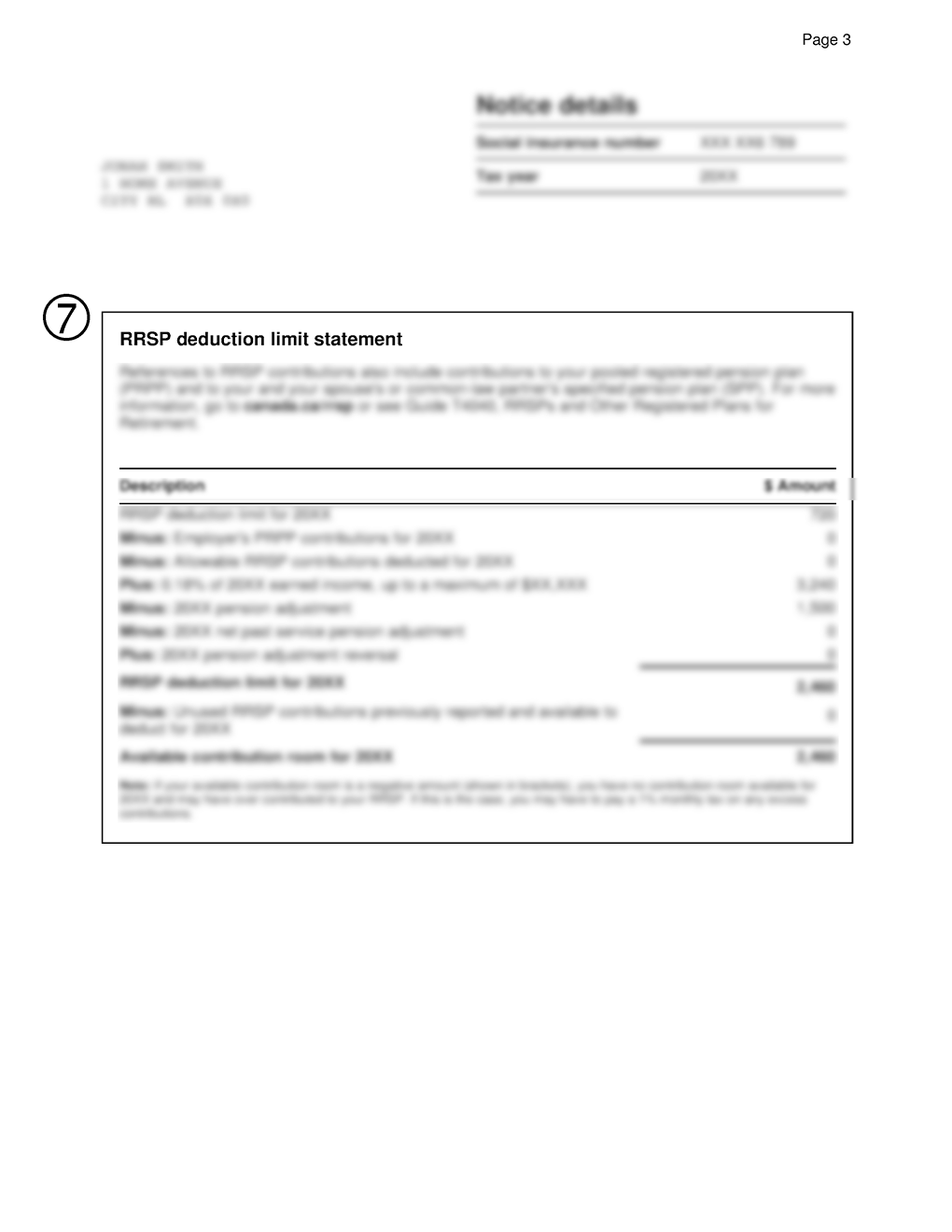

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Gst Rates 2022 List Of Goods And Service Tax Rates Slab Revision

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Correctional Officer Resume With No Experience New 75 Luxury Image Resume Examples For A Retail Manager